80% TransferWise Promo Codes ( TransferWise Coupon Codes) February 2026 Canada

TransferWise Coupon Codes Canada ⭐ Coupons with ♥ from Vancouver » Coupons up to 80% ⭐ 34 deals and TransferWise Promo Codes » Valid February 2026 » Coupons & Deals daily updated ♥ 100% checked! Already 295 times used today!

Best TransferWise Promo Code · TransferWise Discounts & History

- All

- Top Offers

- Coupon codes

- % Discount

- $ Discount

- Free shipping

- Deals

Save on Transfers

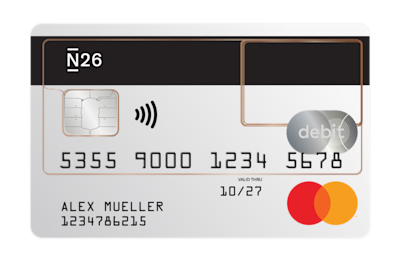

Save more by choosing the right debit card

Save even more with free debit cards like Wise and N26. They help you avoid extra fees, manage online payments, and shop more efficiently, especially at international stores.

First Transfer Discount: Save on International Transfers

Low-Cost International Transfers

Save on international transfers!

Save on International Money Transfers with TransferWise

Send Money Abroad with Low Fees

Save money on international transfers!

Low fees on international transfers

Money Transfer Savings

Money Transfer Offer

First Transfer Discount

Save on International Money Transfers

Transparent Exchange Rates

Sometimes get lower transfer fees!

TransferWise First Transfer Discount

Low-Cost International Money Transfers

Transfer money abroad with no hidden fees!

Save on International Transfers

Low-Cost Money Transfers

Save money on international transfers

Low Fees, Big Savings

Save on International Transfers with TransferWise

Money Transfer Offer!

Save on Money Transfers

First Transfer Discount: Up to 10% Off Fees

The most redeemed TransferWise discount codes

| Discount | Description | Expiry Date |

|---|---|---|

| $ 500 | TransferWise discount coupon get a free international transfer of up to $ 5 | 2026-02-28 |

| 80% | Fast up to 80% OFF by sending your money with TransferWise | 2026-03-08 |

| 10% | Money Transfer Savings | 2026-03-02 |

FAQ

What are the current promo codes or offers available for TransferWise in February 2026?

Currently, promo codes and 34 deals available for TransferWise:

Save on Transfers Discount coupon TransferWise cheap international transfer 1st free and you get $ na TransferWise

Order your TransferWise international

Receive and pay with the commercial exchange rate with the TransferWise

How much can I save at TransferWise?

In the last 30 days, 295 members have saved on average 80% at TransferWise.

How do I use TransferWise coupons?

To use a TransferWise coupon, copy the related promo code to your clipboard and apply it while checking out. Some TransferWise coupons only apply to specific products, so make sure all the items in your cart qualify before submitting your order. If there's a brick-and-mortar store in your area, you may be able to use a printable coupon there as well.

How many TransferWise online coupons are available?

There are currently 100+ TransferWise online coupons reported by TransferWise. These deal offers are available online, including coupon codes. Today alone, users have collectively cashed in on 34 offers.

How to save money at TransferWise?

You can save money at TransferWise by using one of the current TransferWise coupons from 1001couponcodes.ca. Right now, the most you can save is 80%.

How long do TransferWise coupons last?

The TransferWise promo codes that are currently available end when TransferWise sets the coupon expiration date. However, some TransferWise deals don't have a definite end date, so it's possible the promo code will be active until TransferWise runs out of inventory for the promotional item.

Content Index

Coupons Statistics

TOP20 discounts Most used discounts Coupons expired soon Coupons with free shipping Exclusive discounts Stores with most discountsCurrent TransferWise discounts

| Discount Codes | 34 |

| Best TransferWise Coupon | $ 500 |

| Working Coupon Codes | 0 |

| Redeemed Codes | 295 |